Are U.S. Treasury Bonds Still Safe? What Negative Swap Spreads Reveal

How regulatory failures, hidden bank losses, and fiscal reality are reshaping credit markets forever

The Erosion of Risk-Free: Lessons from a Credit Market Veteran

In a recent interview, Ali Meli laid out how he's seen the American financial system from multiple angles: as an Iranian immigrant who landed at MIT, a Goldman Sachs credit trader who profited from the 2008 crisis, and now as founder of Monachil Partners navigating today's credit markets. His career trajectory mirrors the evolution of American finance itself—and his current observations suggest the system is approaching another inflection point.

What makes Meli's insights particularly valuable is his ability to connect micro-level credit dynamics to macro-level policy consequences. His experience profiting from the 2008 financial crisis—specifically by shorting under-capitalized monoline insurers—taught him to look beyond surface-level accounting to identify hidden systemic risks. Today, he sees similar patterns emerging but with new wrinkles that suggest the next decade will bring fundamental changes to how we think about risk and return.

The Great Credit Migration

Meli has built his business around a central thesis: credit formation is migrating away from deposit-taking banks toward asset management firms. This isn't merely a cyclical shift but a structural transformation driven by regulatory changes and technological disruption. Banks, saddled with approximately $500 billion in unrealized losses on Treasury holdings and constrained by regulations that paradoxically encourage risky accounting practices, are retreating from many traditional lending activities.

This retreat creates opportunities for nimble managers like Meli, who can step into the gaps and command better returns for taking the same credit risks that banks once accepted at lower spreads. Monachil's strategy of lending to specialty finance companies—essentially becoming a "lender to lenders"—exemplifies how sophisticated capital can profit from this structural shift while potentially providing more stability than the deposit-funded model it's replacing.

It is ironic that in attempting to make banks safer after 2008, regulators may have inadvertently made them more opaque and systemically risky. By allowing banks to classify assets as "held-to-maturity" and avoid mark-to-market accounting, they've recreated the conditions that led to Silicon Valley Bank's collapse—where massive interest rate risk was hidden in plain sight.

This regulatory failure exposed what Meli sees as a growing list of institutional conflicts: "There is more conflict of interest between Fed, the regulator, and Fed, the determinant of monetary policy. And when they fail as regulators to regulate banks, it sounds like they are not shy about using monetary policy to cover up the regulatory failure."

The Risk-Free Rate Mirage

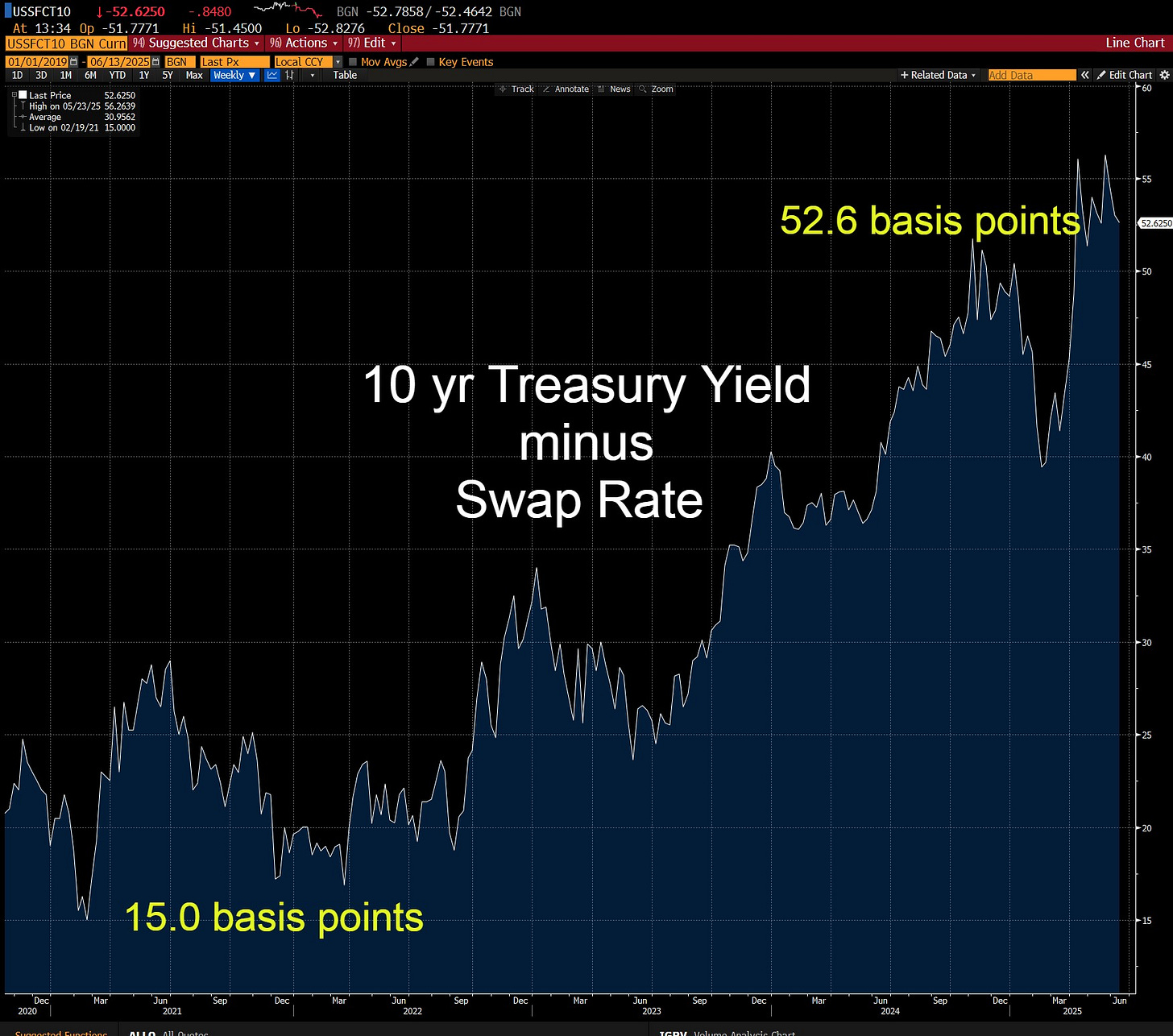

Perhaps the most striking signal Meli identifies is the inversion of a relationship that has defined modern finance: Treasury yields now trade roughly 50 basis points wider than interest rate swaps. This technical detail carries profound implications that extend far beyond trading desks.

For decades, U.S. Treasuries served as the bedrock "risk-free rate" upon which all other assets were priced. If you could earn a certain return on Treasuries with theoretically zero credit risk, any other investment had to offer a premium above that rate to compensate for additional risk. This hierarchy provided a stable foundation for asset pricing and portfolio construction.

Today's inversion suggests markets are quietly rethinking the notion that Treasuries represent the ultimate safe asset, especially because the 30 yr basis of 86.2 is 50.9 basis points higher than the 5 yr basis of 35.3bp suggesting that the longer you wait to be repaid, the higher the rate you receive. When swap rates trade inside Treasury yields, it signals a fundamental shift in how markets assess risk—moving beyond simple credit hierarchies to reflect concerns about liquidity stress, regulatory pressures, and the real value of holding government bonds. This development doesn't represent renewed faith in banking sector stability, but rather growing skepticism about America's fiscal sustainability. Investors are beginning to price in not merely repayment risk, but the more insidious threat of holding assets that may steadily erode in purchasing power.

The Debasement Dilemma

The underlying driver of this shift is a growing recognition that the United States faces an almost impossible fiscal equation. With deficits running at 7% of GDP and debt service costs escalating as rates rise, the government confronts limited and politically painful options: dramatically cut spending, significantly raise taxes, or continue printing money to service obligations.

Market participants understand that explicit default remains highly unlikely, but implicit default through currency debasement appears increasingly probable. When the federal government issues new debt to pay interest on existing debt while running massive primary deficits, the mathematical endpoint becomes clear even if the timeline remains uncertain.

This creates a paradox for investors. Treasuries may indeed return their full nominal value, but their purchasing power should continue to erode significantly over time. In this environment, the traditional concept of "risk-free" becomes oxymoronic—investors aren't just concerned about getting their money back, but what that money will buy when they do.

The Path Forward

Meli's outlook for the next 3-10 years balances sobering realism with measured optimism. He believes America retains the institutional capacity to address these challenges, but only through politically difficult adjustments that could involve spending cuts, tax increases, and potentially beneficial deflation from technological innovation.

The AI revolution could provide a crucial escape valve by driving productivity growth that outpaces debt accumulation. If artificial intelligence delivers the promised efficiency gains across the economy, it might generate the growth needed to grow out of our fiscal predicament—much as the internet boom helped balance budgets in the 1990s.

For investors, this environment demands a fundamental recalibration. The safe haven of risk-free Treasuries is becoming a mirage. Success will increasingly depend on identifying managers who can navigate credit markets with both technical expertise and macro awareness—professionals who understand that in a world of persistent debasement, standing still means moving backward.

Meli's story embodies this new reality: an immigrant who leveraged American opportunity to build expertise in crisis, then used that knowledge to create value in an evolving system. His success suggests that while the old certainties may be crumbling, new opportunities await those skilled enough to recognize and capture them.

Thank you very much to our sponsors:

Truflation: Learn about what prices are actually doing by going to https://truflation.com/marketplace/us-inflation-rate

Foundation: Protect your Bitcoin using the latest off-line technology with easy-to-use Passport. Their next product, Passport Prime will protect all passwords off-line with even-better technology. https://foundation.xyz/

River Financial: If not cold storage for your Bitcoin, I’d highly recommend River for buying and holding- River is engineered to protect your Bitcoin over the long run. Use this link for discounts: https://river.com/signup?r=T7GGAF7G